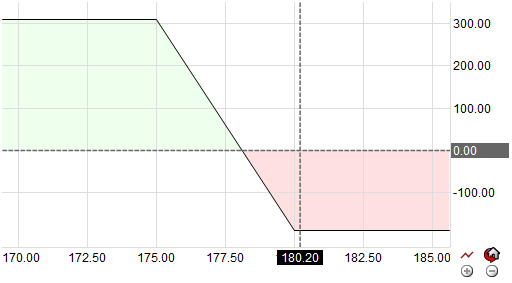

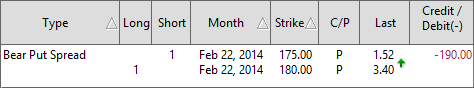

A Bear Put Spread, is another vertical type spread that involves simultaneously buying a higher put option and selling a put option with a lower strike price with the same expiration date. A Bear Put spread is employed when the trader predicts the price of the stock or asset will go down moderately over the near-term. The goal is to sell the combined position at a price that exceeds the overall purchase price and profit. This type of spread is one of the most popular bearish options strategies and profits when the stock falls.

Summary: A Bear Put Spread entails buying a put option with a higher strike and selling another lower strike put option thus producing a net debit. This strategy is more effective when the market outlook is moderately bearish or the volatility is increasing.