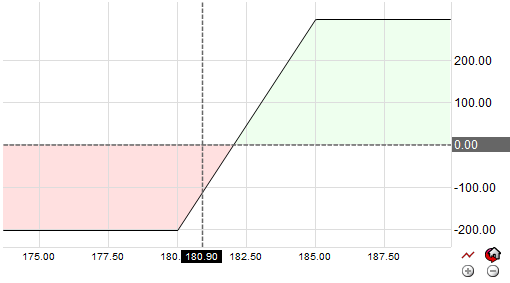

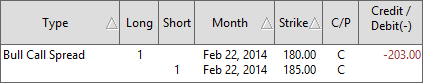

A Bull Call Spread is a bullish spread position between two strike prices. It is a type of vertical spread where you simultaneously buy 1 call and sell 1 higher strike price call with the same expiration. This strategy requires an initial outlay of cash, hence why it is also called a debit call spread. This spread strategy is used when you anticipate the stock or asset moving upward in the short to near-term but the extent of the move is less certain.

Summary: The Bull Call Spread is when the investor simultaneously buys 1 call and sells 1 higher strike price call where both options expire at the same time. It limits the risk associated with buying outright the stock but it also limits the reward potential. This strategy is designed to work best in an overall mild to moderate bullish market.