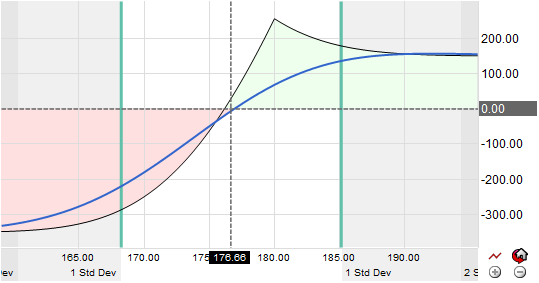

The Bull Call Diagonal spread strategy is a limited-risk, limited-reward play initiated by opening simultaneously long and short option positions with different strike prices and expiration dates. It is similar to a calendar call spread in that it consists of two calls with different expirations, but differs from a calendar spread because the strikes differ. The call diagonal spread can be structured to profit from either an increase or decrease in the underlying asset. The greater the spread between strikes the wider range of profitability.

The long call expires after the short call. The position will profit if the underlying asset does not change much. The value of the short leg will decay faster than the value of long leg. The long leg can be sold when the short leg expires.

This spread is useful when investors are predicting the asset or market will stay bullish in the longer-term but neutral to mildly bullish for the short-term.

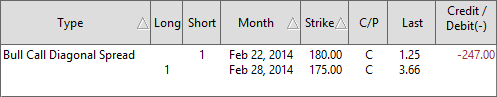

Summary: A Bull Call Diagonal spread involves options from different expiration months and with different striking prices, and is used as a way to generate income using controlled leveraging when the trader determines a market is only mildly bullish to neutral in bias as a part of an overall longer-term bull market trend. It consists of buying a lower strike call when selling a higher strike call at a debit and will, typically, mean buying an at or in-the-money option while selling an out-of-the-money option. The maximum and minimum profits, loss, and breakeven points depend on the strike prices and chosen expiration dates. The maximum profit cannot be easily be determined in advance the value of a call at a future time is not easy to determine as it nears the expiration date and time.