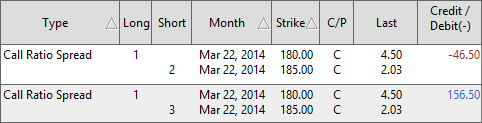

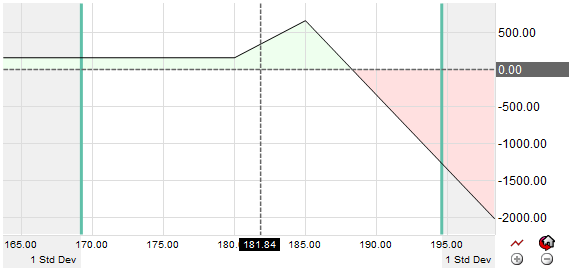

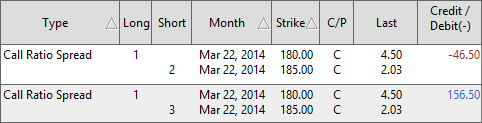

The Call Ratio Spread is a neutral two leg spread constructed to take advantage of markets with little expected movement in price. The spread is built at a 2:1 or 3:1 ratio by purchasing an in the money call while selling 2 or 3 out of the money calls. If 2 in the money calls are purchased the trader would sell 4 or 6 out of the money calls to keep the trade in the proper ratio. This trade can result in a net debit or in some cases a net credit to the account. If the trade results in a net credit and the underlying stock moves lower than the in the money call a profit will be made at expiration, the maximum gain is achieved if the underlying stock is at or near the price of the long call at expiration. The maximum loss is unlimited and the strategy should be followed by an aggressive money management plan.