Comparative Relative Strength is an indicator that allows a comparison of the price movement of a stock with another stock, sector, or index. The primary comparison being made is between similar stocks in the same industry or category. Comparisons can also be made between a stock and its competitors or a stock with the overall market index. Traders like to focus on trading in areas where the strongest up or down trends exist. It can be an individual stock or a specific group and sector.

One of the primary comparisons happens when you compare two securities to show how the securities are performing relative to each other. We start the comparison by looking at a security's price change with that of a "base" security. When the Comparative Relative Strength indicator is moving up, it shows that the security is performing better than the base security. When the indicator is moving sideways, it shows that both securities are performing the same. When the indicator is moving down, it shows that the security is performing worse than the base security.

Comparative Relative Strength is often used to compare a security's performance with a market index. It can be useful in developing spread trades where, for example, you buy the better performer and short the weaker issue.

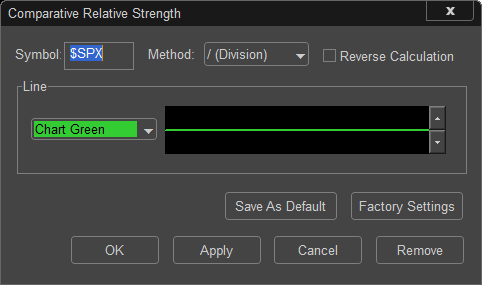

Comparative Relative Strength Setting Dialog: