Bearish Daily Doji: This scan identifies stocks that have experienced a recent uptrend on the daily chart and, on the prior trading day, opened and closed at the same price. Additionally, the stock is experiencing current weakness and is moving lower following the Doji or same open and close price. This would indicate a reversal and potential pressure to the down side.

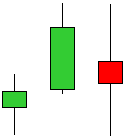

Bearish Engulfing: Bearish Engulfing patterns occur when a stock closes higher than its opening price during the trading day. The previous trading day had a pattern of a higher high and lower low during the trading day, but closed below the prior day's low. When these two consecutive trading day patterns are met, the stock lands on the Bearish Engulfing scan list and is a potential sell candidate.

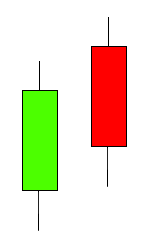

Dark Cloud Cover: Dark Cloud Cover is a candlestick pattern that indicates a potential downtrend. This pattern occurs over two trading days. In the first trading day, a stock closes above its open for the period. During the next trading day, the stock opens above the prior day's close and closes both below the current day's open and the mid-point of the prior day's range. This indicates a potential short selling opportunity.

Hanging Man: The Hanging Man is a bearish reversal pattern that can also mark a top or resistance level. Forming after an advance, a Hanging Man signals that selling pressure is starting to increase. The Hanging Man chart pattern confirms that sellers pushed prices lower during the session. Even though the bulls regained their footing and drove prices higher by the finish, the appearance of selling pressure raises the yellow flag. As with the hammer, a Hanging Man requires bearish confirmation before action. A sharp sell off after this pattern will trigger a stock to make this scan list.

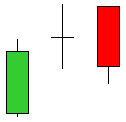

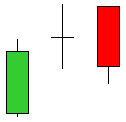

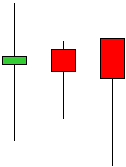

Bearish Harami: This trend is defined by a large candlestick followed by a much smaller candlestick whose body is located within the vertical range of the larger candle's body. Such a pattern is an indication that the previous upward trend is coming to an end. A Bearish Harami may be formed from a combination of a large white or black candlestick and a smaller white or black candlestick. The smaller the second candlestick, the more likely the reversal. Typically, it is a strong sign that a trend is ending when a large white candlestick is followed by a small black candlestick.

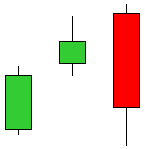

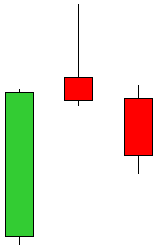

Evening Star: This trend is defined by a bearish candlestick pattern consisting of three candles that have demonstrated the following characteristics:

1. The first bar is a large white candlestick located within an uptrend.

2. The middle bar is a small-bodied candle (red or white) that closes above the first white bar.

3. The last bar is a large red candle that opens below the middle candle and closes near the center of the first bar's body.

Evening Star formations can be useful in determining trend changes, particularly when used in conjunction with other indicators. Many traders use price oscillators and trend lines to confirm this candlestick pattern.