Donchian Channels are basically a price channel algorithm that plots the highest high and lowest low over a specific time interval. It displays those levels as channels to the upper and lower ranges of a price movement. These channels are generally used to indicate support and resistance levels based on the variable it is set for.

Richard Donchian did research in the early 1970's when trying to develop a mechanical trend trading technique for futures trading that would keep you in the right side of any market trend. From his research came what we now call "Donchian’s Four Week Rule."

The Four Week Rule general strategy is as follows:

Cover shorts and go long when price exceeds the highs of the previous four weeks. Go short and liquidate longs when price falls below the lows of the previous four weeks. A third, often forgotten rule that relates to futures traders, is to roll forward, if necessary, into the next contract on the last day of the month prior to expiration.

Many commodity trading funds keep a close eye on 20-day levels and buy a breakout above, or sell a break down below these levels.

The four week rule can be modified to make it non-continuous by using a shorter time frame, such as a 1 or 2 week for liquidation purposes. For example, a four week breakout would have to be confirmed by the 1 or 2 week signal, and a move by the shorter time frame in the opposite direction would lead to a liquidation of the position.

The logic behind Donchian Channels is based on the notion, "to ride your profits, while cutting losses quickly." Another logic behind Donchian Channels is that it should help minimize "over-trading." One tends to be locked into a position. Critics will say it doesn’t pick the tops and bottoms, and some think the approach too simplistic. Some say Donchian Channels are analogous to the use of Stochastics, where you generate overbought and oversold signals that you attempt to trade, but with the graphic overlay to guide you.

Many trend based systems will try to combine the use of Donchian Channels with other technical tools to try and trade the overall trend. A typical trader might try to time his exits and entries as soon as the price crosses above or below a channel line, for example.

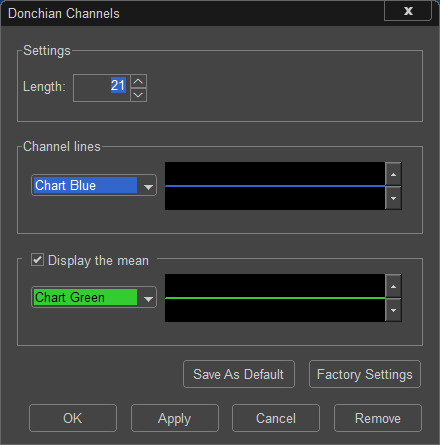

Donchian Channels Settings Dialog: