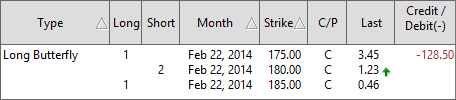

The Long Butterfly is an advanced three-legged options strategy designed to help create a limited risk and reward scenario. It is used when the market is neutral or bearish on volatility, and helps traders take advantage of high premiums during times where a stock is trading in a stable trading range. Long Butterfly spreads are similar to a short straddle but your losses are limited. Under this spread strategy you make your money when the stock remains flat over the life of the options.

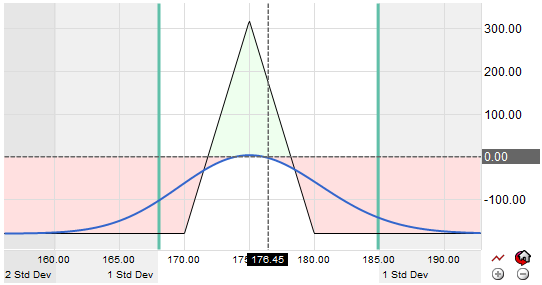

This spread is essentially a combination of two vertical spreads, one credit and one debit spread. It is called a "butterfly" because the shape of the risk characteristics involves a body and wings similar that resemble a butterfly. The Long Butterfly can be described as "selling the body and buying the wings" because it involves selling one strike for the body of the spread and buying half as many of a higher strike for one wing and a lower strike for the other wing. The price target is the middle strike or the body. There are similar dynamics to buying a call spread and selling a higher strike put spread.

Summary: A Long Butterfly spread is used by veteran traders who anticipate a stock or market is going to be trading in a narrow trading range and has very little volatility. It is a more advanced options strategy used to take advantage of time premium erosion of an option contract where risk and reward potentials can be better controlled with limited and known risk. Often a market trades in a range when it has moved too quickly or if there are economic risks that cause market players to be more cautious. If a butterfly spread is implemented properly the potential gain is higher than the potential loss, but both the potential gain and loss will be still have limits during these potentially more risky trading times, particularly when trends are harder to predict. While the butterfly spread is generally considered a neutral spread strategy it can be skewed to the bullish or bearish side by simply altering the strike prices or utilizing puts instead of calls.