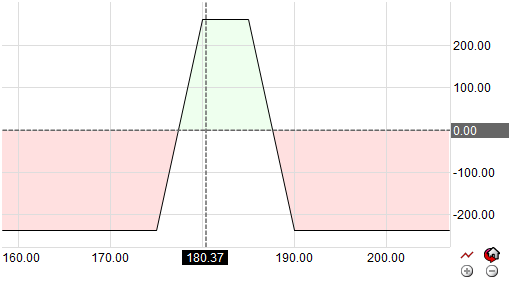

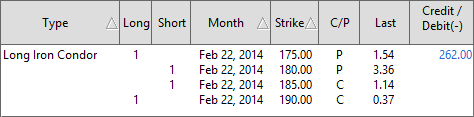

An iron condor is one of the most popular and complex advanced neutral options strategy that involves a combination of two vertical spreads, simultaneously buying/selling and holding four different options with different strike prices. It is created for neutral markets as a safer way to profit from a stock expected to stay stagnant or trade within a narrow price range. The goal is to leverage the stock movement so the options expire worthless because there is no significant move during the time this spread strategy is created and held.

The iron condor is constructed by holding a long and short position in two different strangle strategies. A strangle spread is where you simultaneously buy an out-of-the-money call and an out-of-the-money put option with the same expiration date. The potential for profit or loss is limited in this strategy because an offsetting strangle is positioned around the two options that make up the strangle at the middle strike prices.

Summary: An iron condor spread strategy is a way of attempting to profit from the options contract market when the market does not move very much. Often these contracts expire worthless because there is no significant movement during the time this spread strategy is put on. The iron condor spread is a complex vertical spread built of two short verticals designed to optimize trading this kind of a neutral, non-directional market. It basically is a combined put and call condor spreads put on at the same time with the same underlying, same expiration month and works best when the underlying asset is anticipated to change very little over the life of the options.