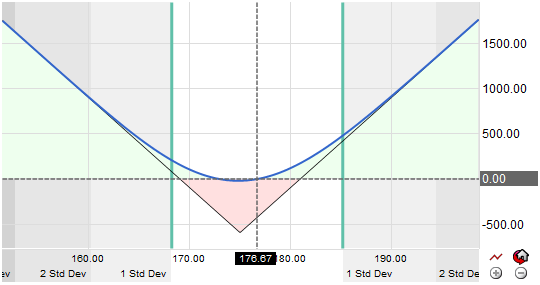

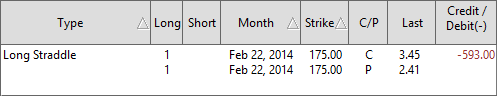

A Long Straddle spread is a neutral options strategy used, most often, by short-term traders who anticipate a big move either up or down coming in a stock or other asset before the option expires and you either don't have a preference or know what direction the move will occur. This phenomenon occurs, most often, during the quarterly earning season when the market expects one thing but the company delivers different results. It can result in violent moves. Straddles spreads are designed specifically for high volatility conditions where markets can swing back and forth often in wild swing moves. Investors who are expecting volatility in the underlying security purchase long straddles.

Summary: You want to enter the long straddle spread when the stock is fairly calm and actually predicted to breakout but you don't know which direction. It is not a good time to establish a long straddle spread when the volatility has already moved because the premiums are already priced into the options.