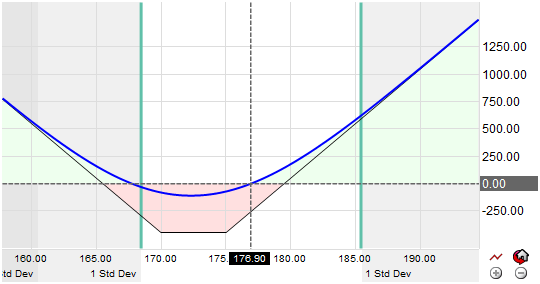

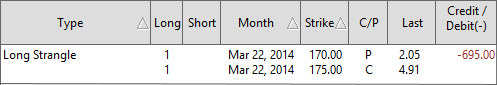

The long strangle spread is an neutral options strategy similar to a long straddle spread in that it involves going long a call option and a put option of the same underlying security. It involves options that expire at the same time, but unlike a long straddle, the options have different strike prices, typically with a higher call strike and a lower put strike. A long strangle typically has a wide spread between the strikes and is cheaper than a straddle but it still requires a larger movement in the underlying asset before the position is profitable.

With a straddle or strangle you are betting that the price will move sharply. Strangles can typically be less expensive if the strike prices are out-of-the-money. This type of trade is often referred to as the "poor man's straddle." It makes a profit if the underlying asset price moves far enough away from the current price in either direction above or below. The trade off is the trade will expire worthless. Most investors take a long strangle position if they think the underlying asset has highly volatility and has the potential to make a large sudden move, they just don't know which direction that move will occur, and they will establish this position within a week or few days before earnings are announced when volatility is still reasonably low prior to the announcement.

Summary: The strangle spread strategy is primarily a volatility play that is established when the underlying asset is believed to be very capable of making a large sudden movement in price but the direction that occurs is not as easy to figure out. This type of event often occurs during things like earnings season where much higher volatility exists.