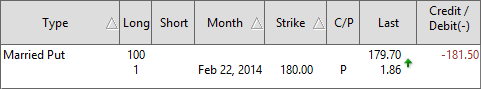

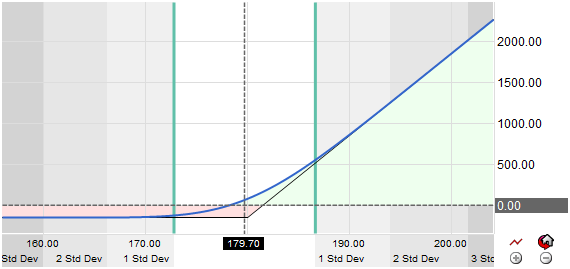

The Married Put is considered to be a bullish strategy in which the trader buys a call to protect and underlying stock position as a hedge against a decline in the option price. Many traders use this strategy as an alternative to placing a stop on a position they have in their portfolio. As the owned stock declines in price the Put purchased will increase in value which offsets the loss in the underlying. If the stock advances the Put option will expire worthless however the rise in the stock price will offset the value of the Put that was lost.