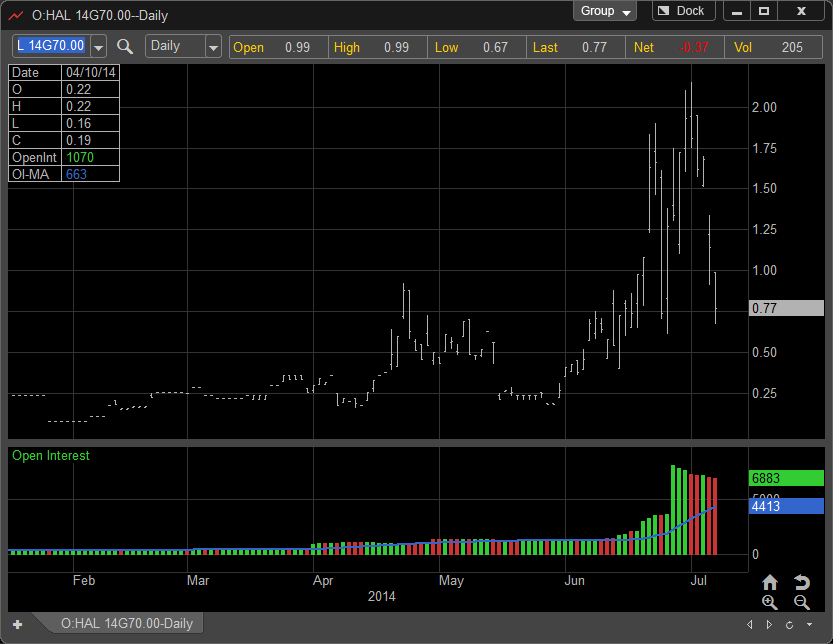

Open Interest is the amount of futures or option contracts that are currently open at a given time that have not been closed by an offsetting trade or assignment. This study is often mistaken for volume which is traditionally the total number of contracts or shares traded.

For example, if open interest is at 100 for stock XYZ and a trader buys 10 contracts that are not being offset by another traders existing position the open interest will increase to 110. If the purchase offsets another traders position than the open interest on that option will stay at 100 as the transactions offset each other and no additional contracts are created.

This study will only display on daily or higher time frame individual options contract or futures charts.

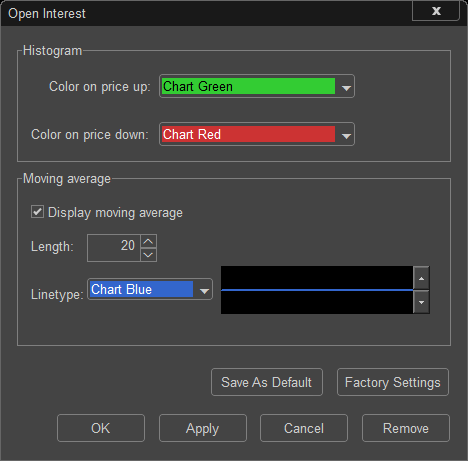

Open Interest Settings Dialog: