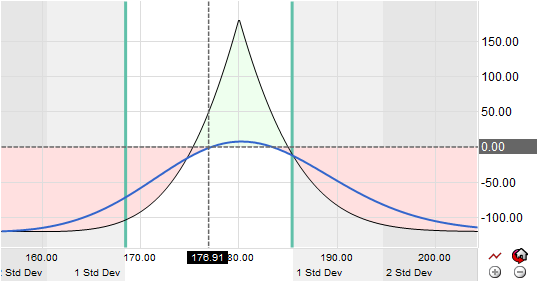

The call calendar spread, also known as a time or horizontal spread, is a versatile neutral options spread strategy that profits from a stagnant or non-trending market. The calendar gets its name because it involves two options in the same asset that expire in different months. A put calendar spread has a longer-term bearish bias within the current neutral range bound trading.

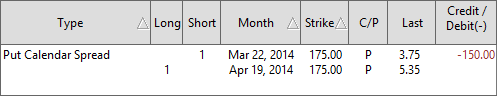

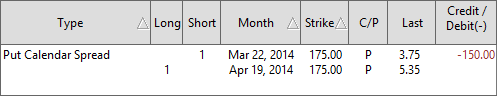

The typical put calendar spread is constructed through two simultaneous trades: (1) purchase of an option, and (2) sale of another option with the same strike price but with an earlier expiration. Two primary uses for call calendar spreads:

- Attempt to profit from range-bound markets.

- Take advantage of the different time decay rates in different expiration months.

Long put option: The first option is a long put with a long-term expiration date. It establishes the bearish bias for the trade and will grow in value as the market drops.

Short put option: The second option is a short put with a short-term expiration. It has the same strike price as the long put you purchased. The identical strike price but different expiration dates is what makes this a calendar spread.

When you enter a put calendar spread you must pay for the long put option but you receive a premium for selling the short put option. The ratio of the premium received from the short put to the price you paid for the long put is much larger than the ratio would be in a diagonal spread.

Summary: The put calendar spread strategy combines a longer-term bearish outlook with a neutral to slightly bullish near-term outlook. The near put will expire worthless if the stock remains steady or rises during the life of the option and the investor ends up owning the longer put option. The strategy will always require paying a premium to initiate the position if both options have the same strike price. One of the advantages of a put call spread you know the potential risk from the beginning.