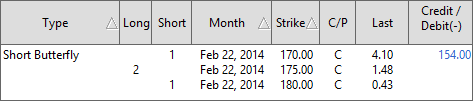

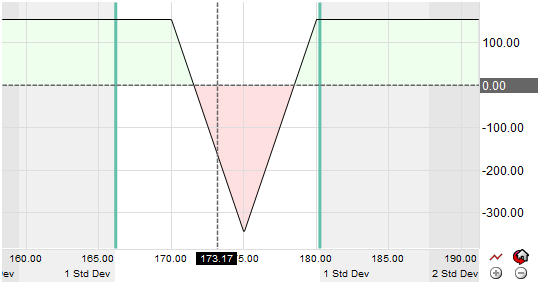

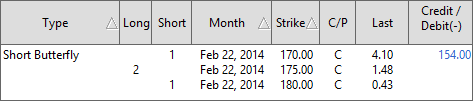

The short butterfly spread, is an advanced three-legged options strategy designed to help create a limited risk and reward scenario. This spread is essentially a combination of two vertical spreads, one credit and one debit spread. It is called a "butterfly" because the shape of the risk characteristics involves a body and wings similar that resemble a butterfly.

Short butterfly spread is used when the market is considered neutral in its market movement bias. The trader doesn't care about what direction the movement goes so long as it has choppiness and higher volatility. The butterfly strategy is basically a spread that helps traders take advantage of high premiums during times where a stock is trading in a volatile trading range. Options for the short butterfly spread have the same expiration.