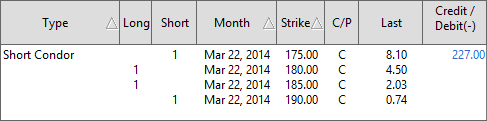

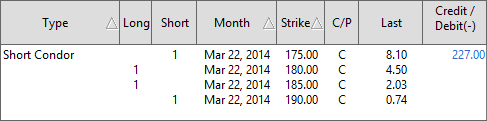

The Short Condor is a four leg neutral option strategy designed for the trader who anticipates a sharp movement in price but is unsure of the direction. In addition, this trade is ideal for high volatility markets as a net credit is established upon placing the trade. The trade is constructed by buying an in then money call and selling an even further in the money call. The second leg of the trade is completed by buying an out of the money call and selling an even farther out of the money call.

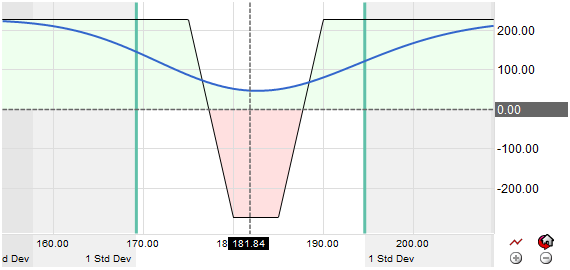

Maximum profit is achieved at expiration if the underlying stock closes outside of the strike price of the calls that were sold.