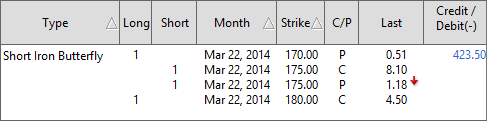

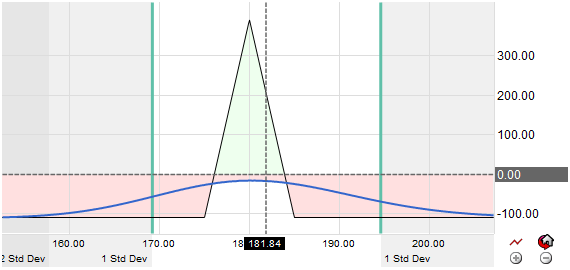

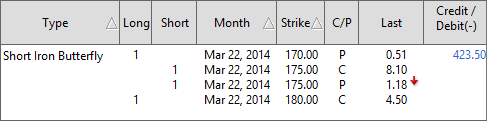

The Short Iron Butterfly is a four leg neutral options strategy constructed by combining a Bear Call Spread and a Bull Put Spread into one single position. This position is placed by the trader who wants to take create income, as a credit is created by the position, by taking advantage of neutral market behavior. The trade is initiated by selling an at-the-money (referred to as the body) call and put creating the credit portion of the trade. The wings of the trade are created by buying an out of the money call and put. The maximum profit (or credit) will be retained if at expiration the underlying price is trading near the body of the spread.