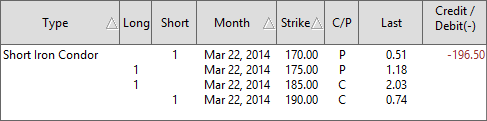

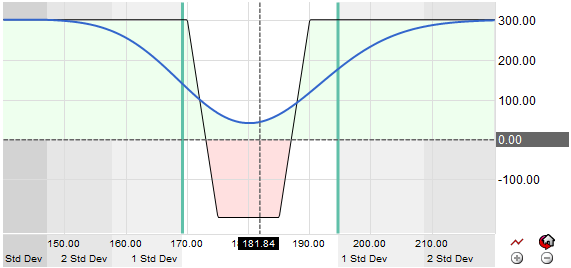

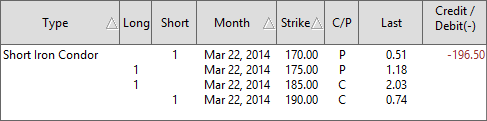

The Short Iron Condor Strategy is a neutral four leg options trade designed to take advantage of a market that is expected to make a sharp movement in price in either direction. The first leg of the trade is constructed as a Long Strangle by buying an out of the money call and put this creates a net debit to the trader. The second leg is created by selling a call and a put farther out of the money than the body of the trade, this portion of the trade creates a net credit which reduces the overall cost of the trade. The maximum profit is achieved if the underlying stock moves outside the wings of the trade at expiration.