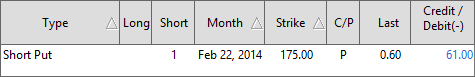

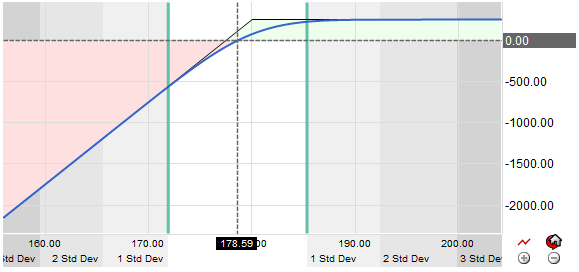

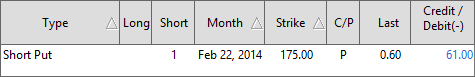

The Short Put Strategy or Naked Put is a bullish options strategy in which the trader sells a Put typically at or out of the money to collect a premium or credit. The goal of the short put is for the stock to stay above the strike price of the option sold so the option expires worthless and the maximum credit is retained.

The maximum gain for the Short Put Strategy is the credit received if the option expires with no value. The Short Put however has a substantial loss potential should the stock decline and should be followed closely with stops. The maximum loss is strike price minus the credit received.