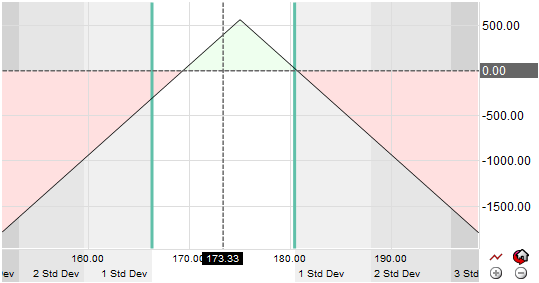

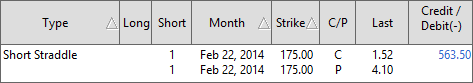

A short straddle spread is a neutral options strategy used, most often, by short-term traders who anticipate a minor move either direction and for the stock to expire close or at the current price. It is the sale of a call and put with the same expiration and strike price which creates a credit. It is different than a long straddle where you anticipate a big move either up or down coming in a stock. You initiate a short straddle spread when you believe the stock is going to not move much and the implied volatility is decreasing.

Summary: You want to enter a short straddle spread when the stock has very good potential to become calm or fairly steady near the spread strike price, particularly as you move closer to expiration. For this spread to work the desire is for volatility to move lower over time and not increase. The longer this happens the greater the odds this spread can expire worthless and the trader is able to keep the premium received.