The Spread Select tools’ main function is to provide the options trader with a more automated approach to choosing an option spread based on pre-built strategies within Options Pro. For a new or even experienced options trader one of the first hurdles they must overcome is the understanding of which options spread strategy they would choose based on their market forecast.

To learn about the different Spread Types click here.

The Spread Select removes this hurdle by listing the Spreads according to market sentiment and suggesting to the trader which spread to use based on that sentiment. The next hurdle to overcome is simply what options contracts need to be bought and sold in a specific spread, again the Spread Select tool using pre-built parameters provides the user the exact options needed to complete the spread and a quick way of placing the trade through the integrated order entry tool. In addition, once the spread is chosen it is analyzed and based off the current Greeks a projected profit and loss can be calculated allowing the trader quick way to sort through many different spreads and choose the most optimal reward-risk scenarios.

Spread Select Window

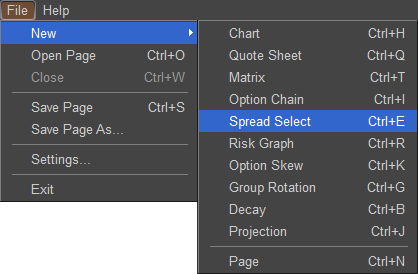

The Spread Select Window can be opened in multiple ways. The first methods is to move your mouse over the SPREAD button and press the left mouse button or click on FILE, select NEW, and choose Spread Select; you can also press CTRL-E on your keyboard.

![]()

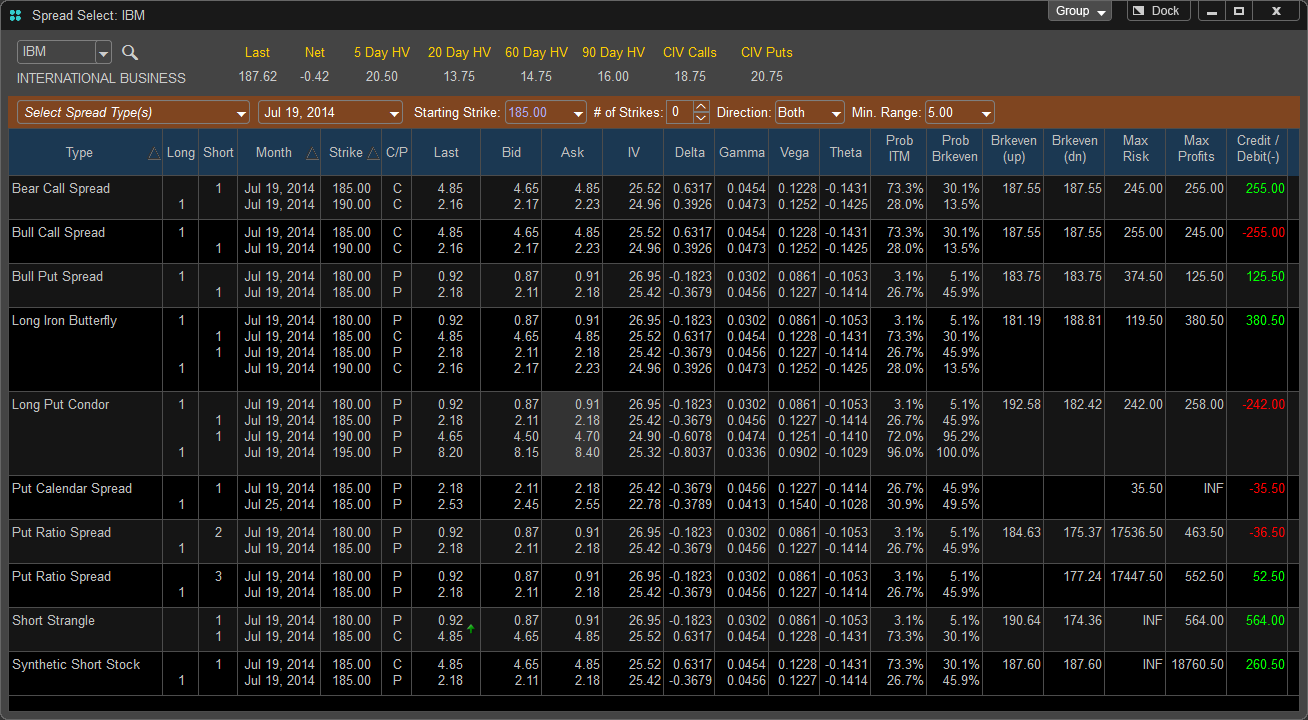

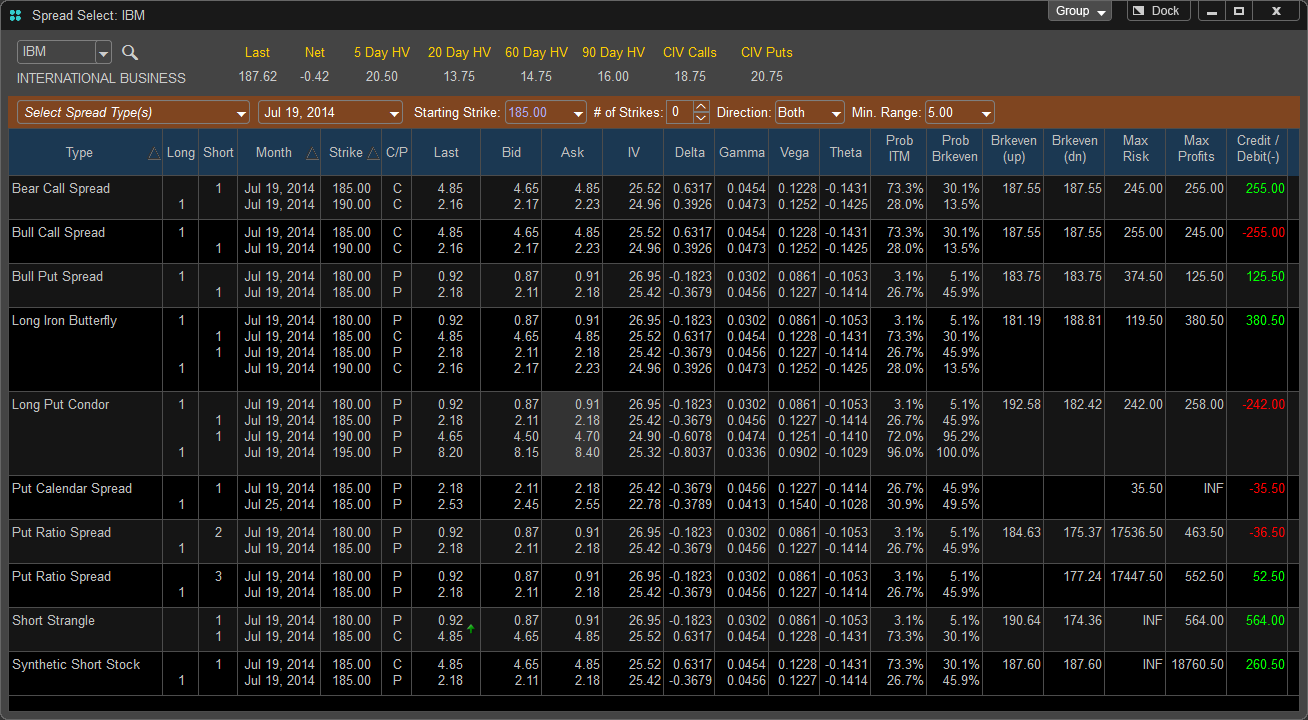

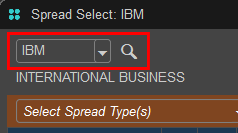

When the Spread Select window is loaded in your application it will default symbol chosen in the Options Pro Preferences (default; IBM) to change from the default symbol, left click in the Symbol window in the upper left hand corner of the Spread Select Window and type in the desired symbol. If you do not know the symbol there is a symbol lookup function which can be accessed by left clicking on the “?” located to the right of the symbol field. Once the symbol is entered press ENTER or on your keyboard to load the Option Skew data.

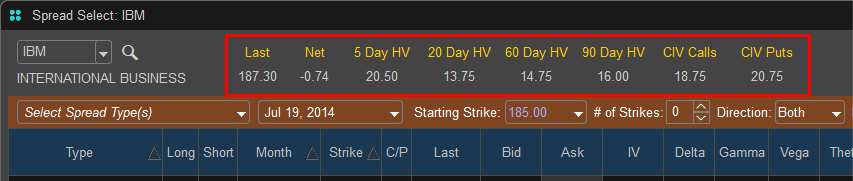

Once the symbol is loaded the Spread Select window will populate and the company name of the stock symbol you entered will appear to the right of the symbol window. In addition, to the right of the symbol window you will be given the last price of the stock which is updated in real time as well as a the values of 5, 20, 60, and 90 Day Historical Volatility as well as the Continuous Implied Volatility of both Calls and Puts.

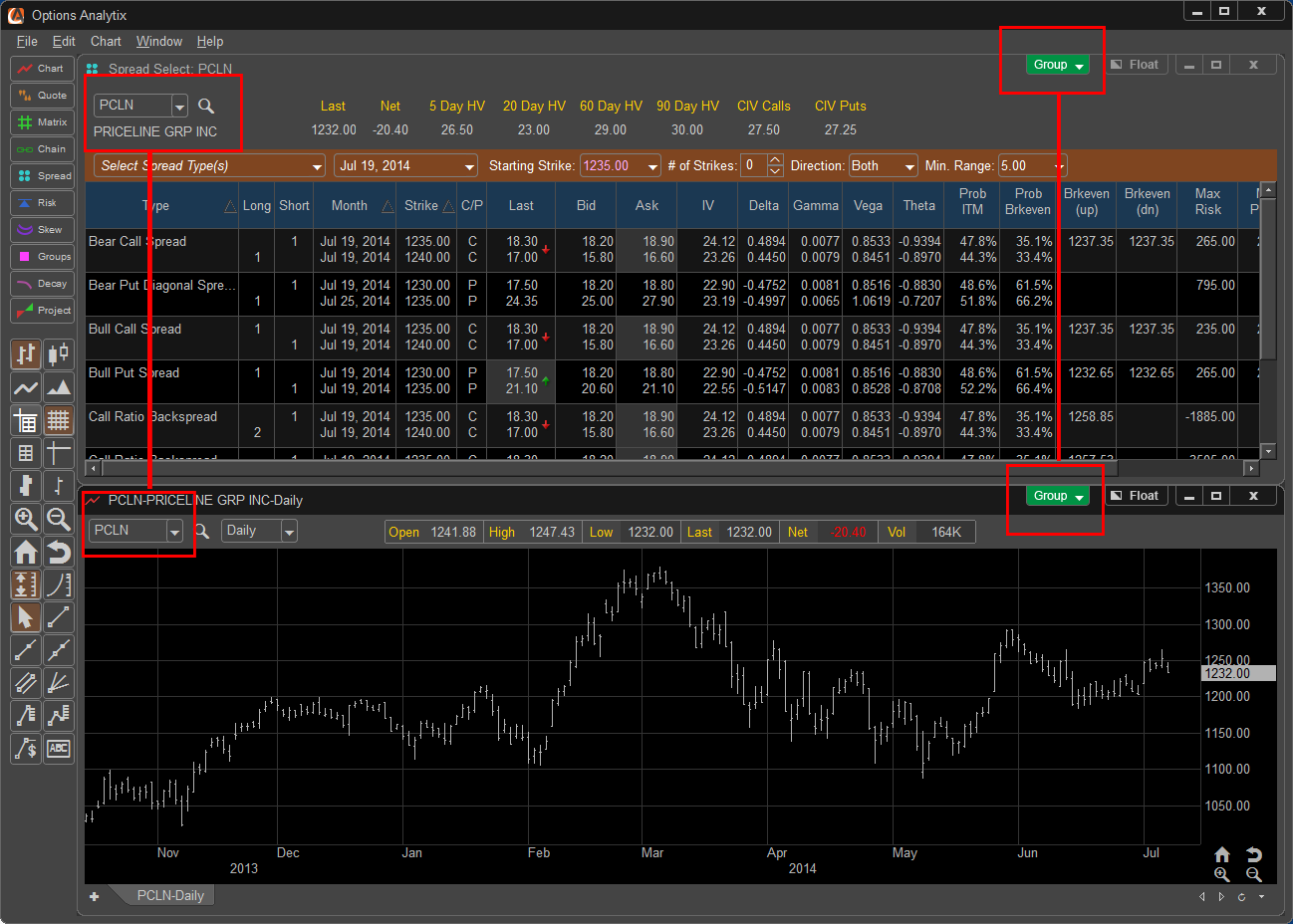

The Spread Select window can be linked with other windows within the application by left clicking on the Group button in the upper right hand corner of the window. This allows the Spread Select to sync with other windows within the application, for example if a symbol is changed on a chart the Spread Select will adjust to the same symbol if those windows are linked together.

![]() Using this option on the chart, enables the chart to be taken out of the main program window. It then can be moved and re-sized anywhere on the screen. When the Page is saved, the window(s) that are outside of the main program will be saved in those locations as well.

Using this option on the chart, enables the chart to be taken out of the main program window. It then can be moved and re-sized anywhere on the screen. When the Page is saved, the window(s) that are outside of the main program will be saved in those locations as well.

![]() This is what will be shown when a window is currently being floated outside of the main program window. To float the window outside of the main window, click on the "Dock" button.

This is what will be shown when a window is currently being floated outside of the main program window. To float the window outside of the main window, click on the "Dock" button.

Spread Selection Criteria

Once the desired symbol is selected you have the option of changing the option pricing and expiration components of the selected spreads as well as adding or removing the spread type that the Spread Select Window constructs.

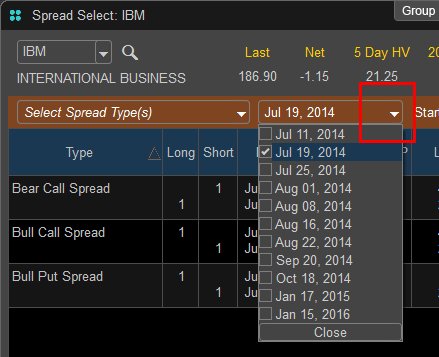

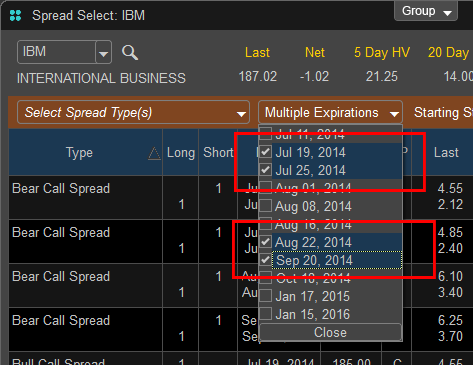

Expiration – By default the Spread Select Window will choose the current front month (monthly expiration) options contract, however if we are within 10 days of expiration the Spread Select will default to the next monthly expiration. To select different options expirations or to choose an additional expiration you can left click on the arrow to the right of the Expiration drop down menu.

To select an additional expiration or to remove an expiration left click on the box to the left of the expiration dates.

When more than one expiration is chosen the window will default to Multiple and spreads will be constructed using the selected expirations in the results window.

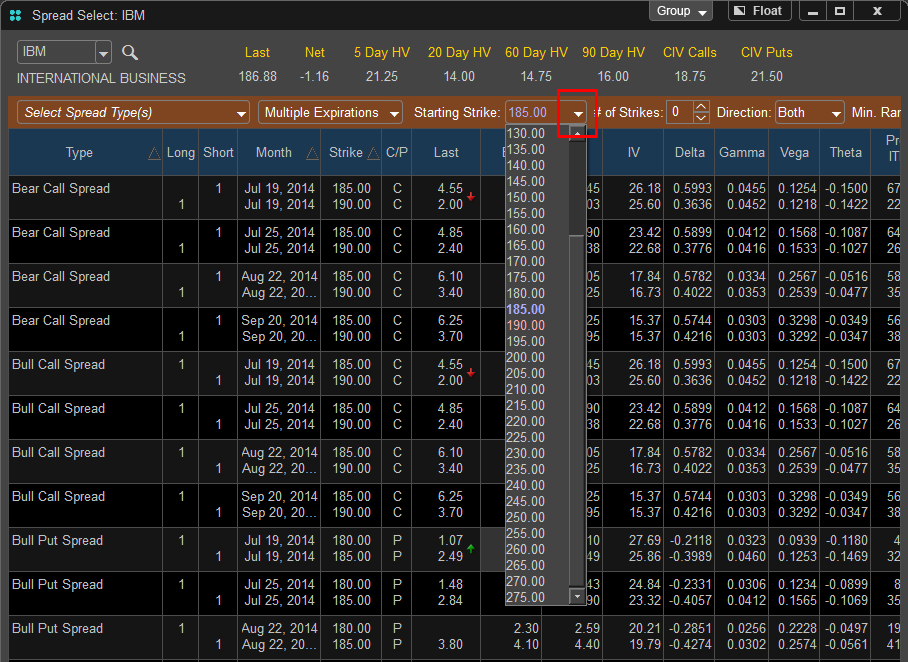

Starting Strike – By default the starting strike is chosen based on the last price of the stock you have selected. The Spread Select will choose the closest at the money strike price to begin the spread construction; this price will be highlighted by red text in the Starting Strike menu. If you wish to start the spread construction with another price left click on the arrow to the right of the menu. Select the new price and the Spread Select will construct the new spreads.

The Starting Strike has been chosen as 200.00 and the Spread Select is now building spreads based on the first leg of the spread being a 200.00 strike.

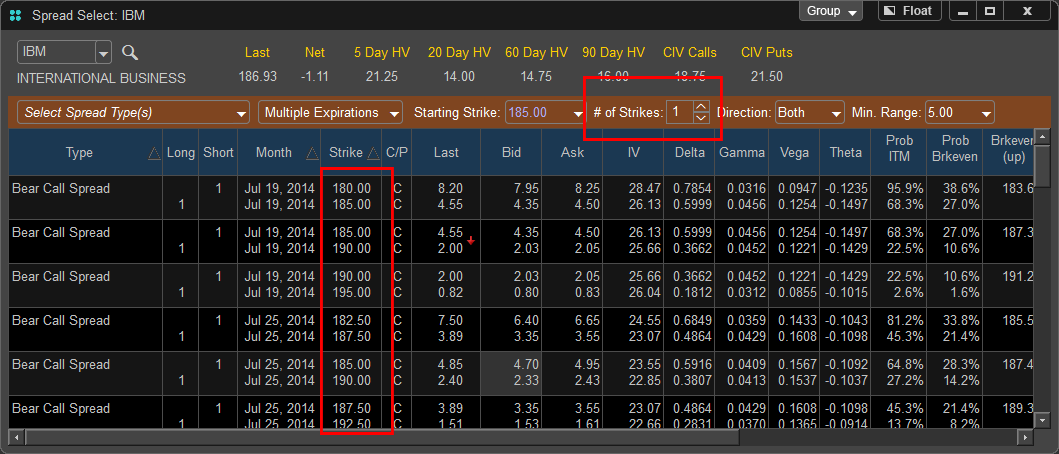

# of Strikes – Enables the Spread Select to create additional spreads above or below the Starting Strike selected. This number by default is set to zero which indicates that if your starting strike is 200.00 than no additional spreads will be created other than the 200.00 strike. By increasing this number the Spread Select will create additional spreads based on the Starting Strike, Direction and Minimum Range.

To change the # of Strikes setting left click either the up or down arrow to increase or decrease the number of strikes. In addition you can left click in the text box and manually type in a number.

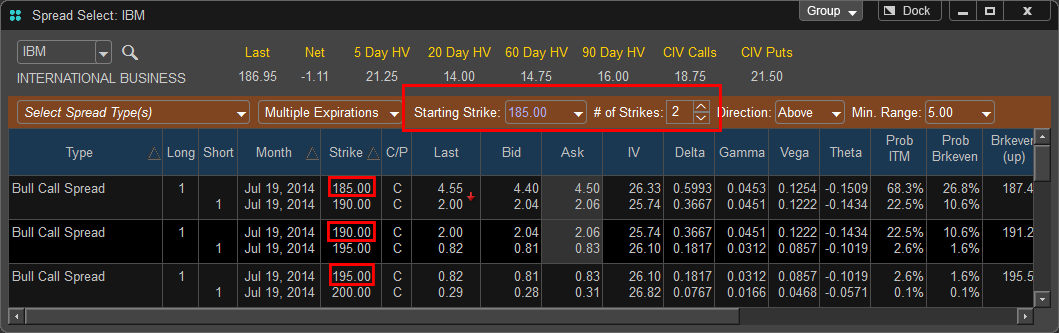

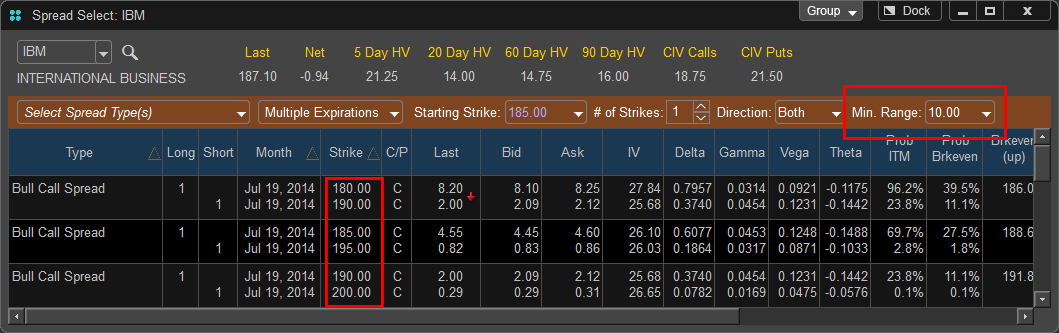

In this example, the Starting strike is 190.00 with 1 Strike selected. Since the direction is set to Both the Spread Select starts the construction with a base strike price of 185 which is 1 strike below, 190 which is the current At The Money Strike, and 195 which is one strike out of the money.

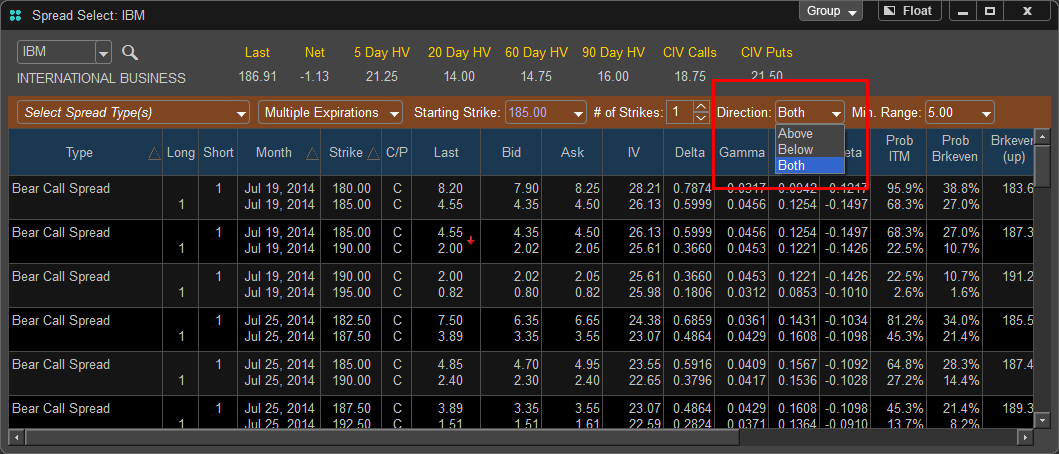

Direction – Allows the user to specify the direction (above or below the money) in which the Spread Selector constructs the spreads. This setting works in conjunction with the # of Strikes selection. To change the direction left click on the arrow to the right of the Direction drop down menu.

In this example the Direction is set to Above and the number of Strikes is set to 2. This instructs the Spread Selector to begin building spreads at the money and to build 2 additional spreads above the starting strike. Since the starting Strike is 190 the Spread Selector creates two additional spreads at strike prices of 195 and 200. The minimum range is also taken into account in this construction.

Min. Range - Sets the minimum range of strike prices the Spread Select will build multiple leg options spreads on. If the minimum price is set to a number lower than the minimum range between the available strikes the Spread Select will build a spread based on the lowest priced strikes available.

To adjust the Min. Range of the spreads left click on the arrow to the left right of the drop down menu and select the desired price range.

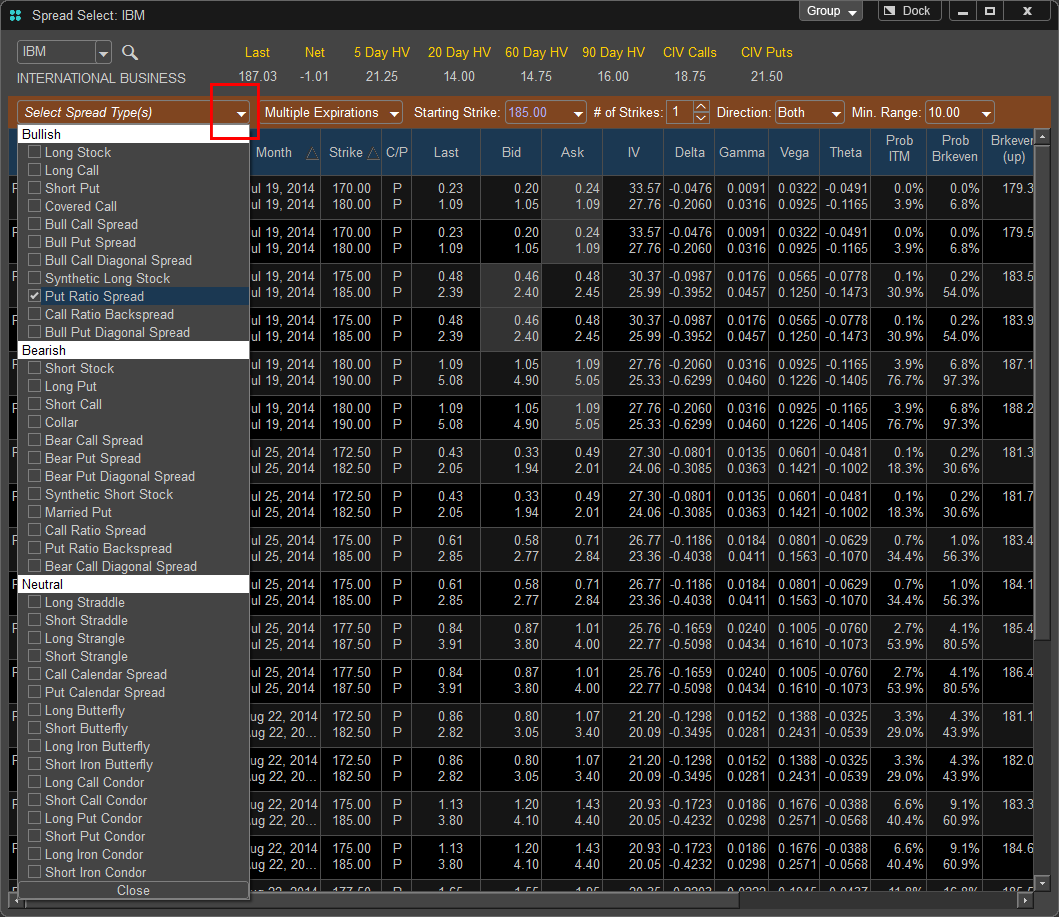

Spread Types

The Spread Select can build spreads based on over 30 pre-programmed strategies, the strategies can be selected or deselected from a drop down menu. To access the menu of included strategies left click on the arrow to the right of the “Select Spread Type(s)” drop down. Spreads are arranged according to the market bias they represent; Bullish, Bearish, or Neutral.

To select a spread for the Spread Select to build place a check mark next to the spread type desired in the menu. To deselect a spread uncheck the box to the left of the spread name. A list of spreads selected will appear to the right of the menu. To access the list entire list of spreads you can left click on the slider bar to the right of the Spread Names.