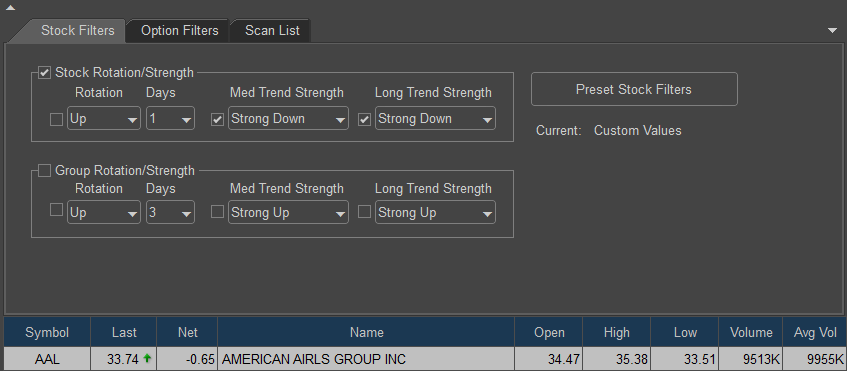

The Stock Filters can be accessed in the Advanced Filters Menu and allow the trader to filter the results of Scan #1 and Scan #2 taking into account Group and Individual Stock Strength or Rotation as reported in the Group Rotation Window and DT Trend Indicator. If the scan is run on individual Option contracts than these filters take into account the strength and rotation of the underlying stock on the options displayed.

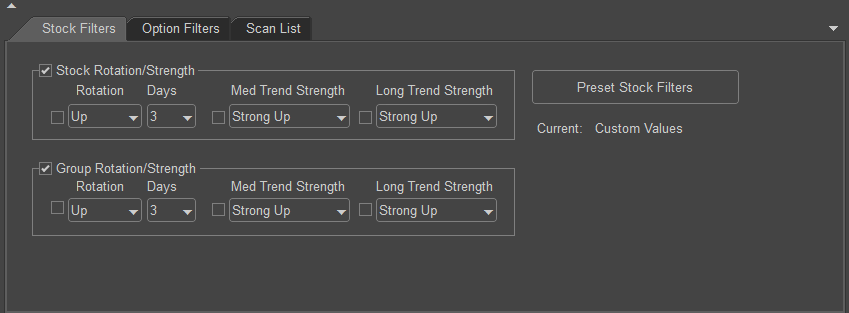

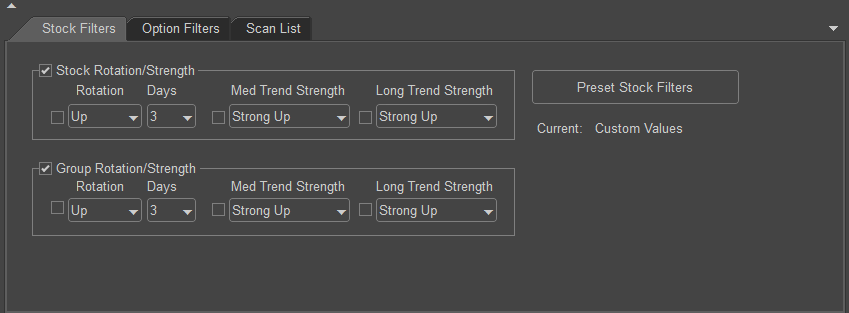

The Group Rotation Filters can be added to the Matrix results by placing a check mark next to Stock Rotation/Strength and/or Group Rotation/Strength and selecting the individual parameters from the menus.

Stock Rotation/Strength

The Stock Rotation/Strength is a measurement of strength based on the underlying stocks strength alone and does not take into account the overall Market or Group/Sector

performance. The study DT Trend is used a base for the filters in this section.

Rotation:

Can be adjusted to Up or Down and number of Days. This filter can be helpful in identifying stocks that are changing trend direction. If the filter is set to the default of Up and 3 Days it will display stocks that meet the criteria of the selections in Scan #1 and #2 and has changed Strength Direction in the last 3 Days. In the below example we can see the strength has changed from down to Up within the last 3 Days.

Trend Strength:

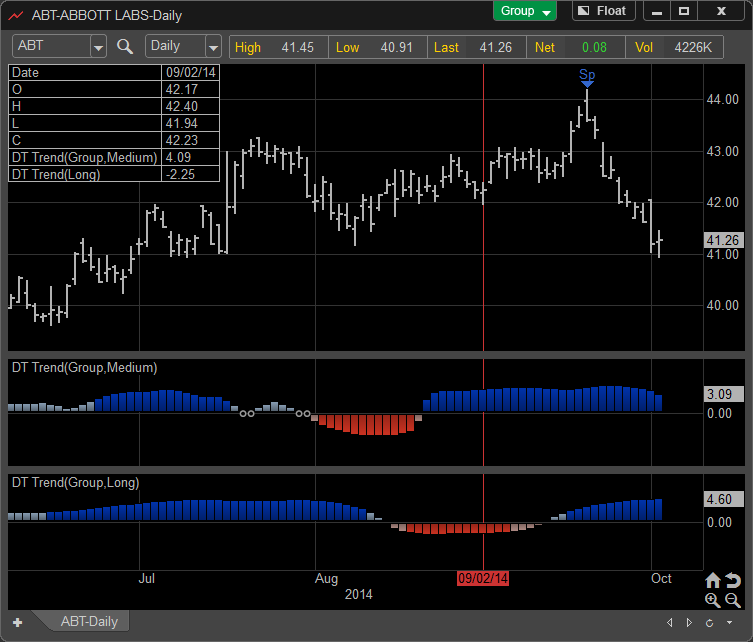

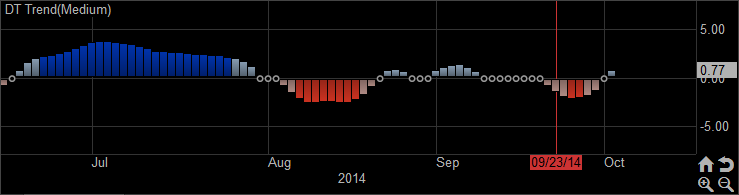

Can be adjusted to Strong Up or Strong Down based on both Med Trend Strength and Long Trend Strength. The DT Trend Indicator identifies Trend Strength based on the color of the bars. Strong Up trends are shown in dark blue and Strong Down are shown in Dark Red. This filter can be used to isolate markets that meet the criteria used in both Scan #1 and Scan #2 and meet the characteristics of Strong Up or Down on either/both Trend Lengths.

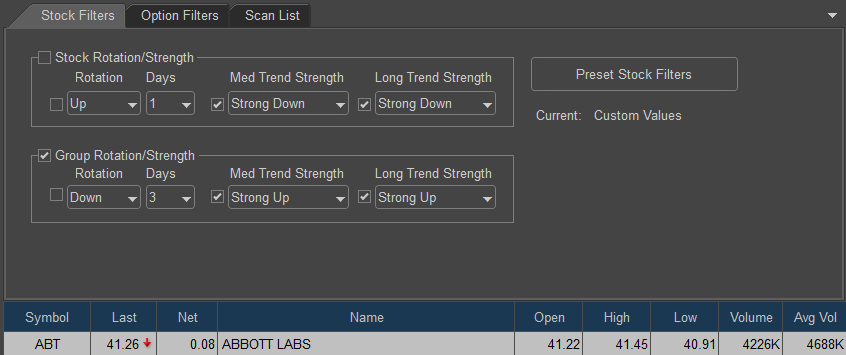

In the example below the Filter has been set to only display stocks that have both long and medium trends to be Strong Down. The DT Trend Indicator displays the condition on the selected Stock.

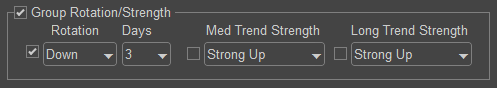

Group Rotation/Strength

The Group Rotation/Strength is a measurement of strength based on the underlying stocks Industry Group performance. The study DT Trend is also used a base for the filters in this section.

Rotation:

Can be adjusted to Up or Down and number of Days. This filter can be helpful in identifying stocks that are members of Industry Groups that are changing trend direction. If the filter is set to the default of Up and 3 Days it will display stocks that meet the criteria of the selections in Scan #1 and #2 and the Industry Group that stock is in has changed Strength Direction in the last 3 Days. In the below example we can see the strength has changed from Up to Down within the last 3 Days.

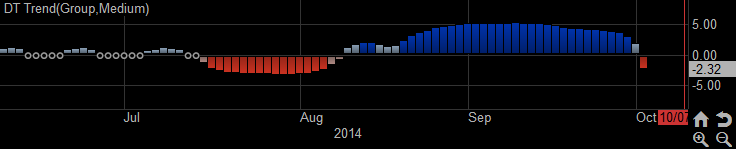

Trend Strength:

Can be adjusted to Strong Up or Strong Down based on both Med Trend Strength and Long Trend Strength of the Industry Group the stock is in. The DT Trend Indicator identifies Trend Strength based on the color of the bars. Strong Up trends are shown in dark blue and Strong Down are shown in Dark Red. This filter can be used to isolate markets that meet the criteria used in both Scan #1 and Scan #2 and meet the characteristics of Strong Up or Down on either/both Trend Lengths.

In the example below the Filter has been set to only display stocks that have both long and medium trends of the Stocks's Industry Group to be Strong Up. The DT Trend Indicator displays the condition of the Group on the selected Stock.