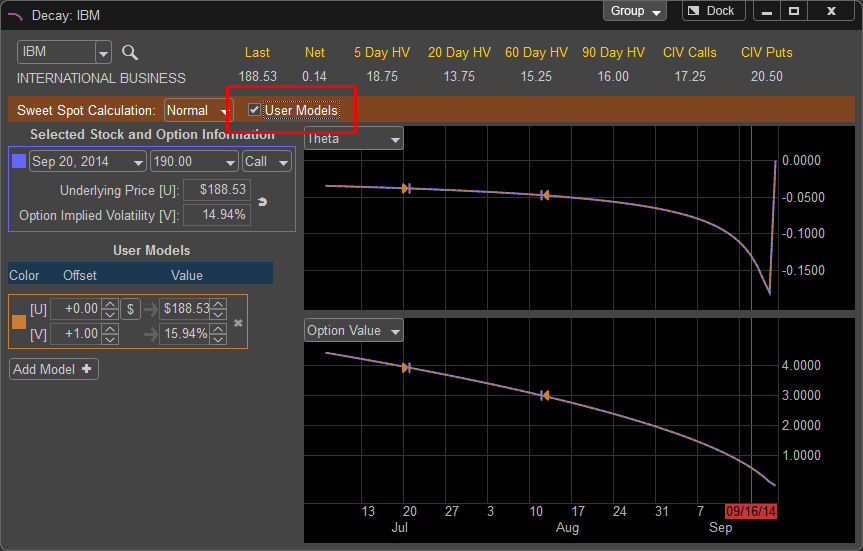

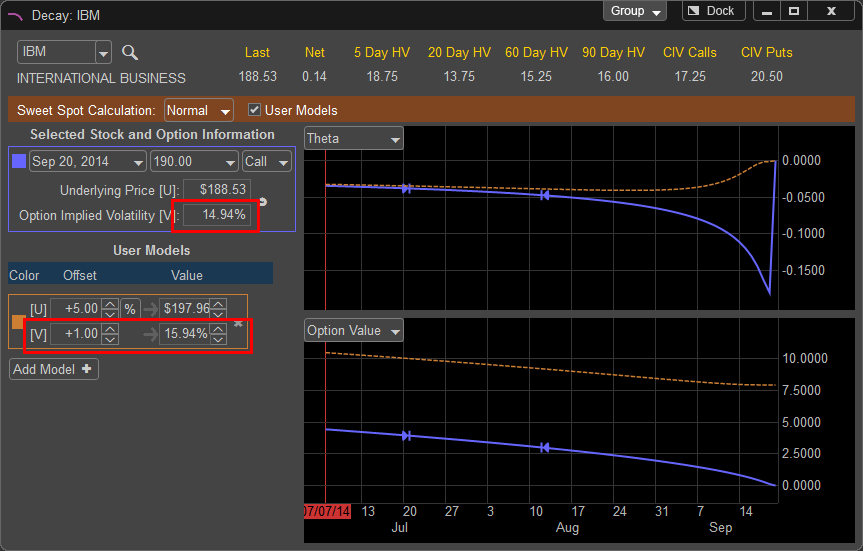

The default Decay Window assumes that both the Price and the Volatility of the underlying issue will not change as the option approaches expiration. If you wish to see how the Greeks and Option Value change as price and volatility change you can model this by checking the User Models box on the main Decay Window.

Left click in the check box to enable the User Model Mode.

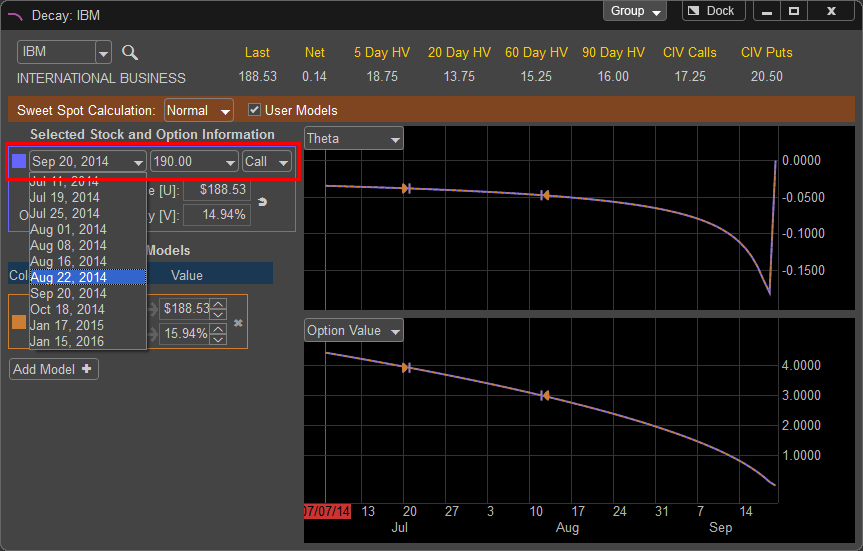

The originally selected option strike and expiration appears on the top of the user models pane, to change this contract click on the drop down menus for the desired Expiration, Strike, or Call/Put.

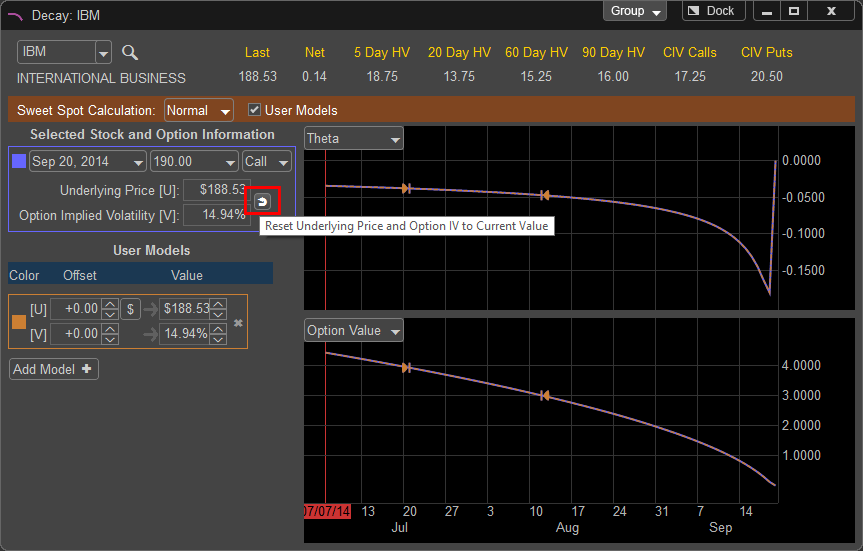

The Decay Window will use the price and implied volatility of the selected option when the Decay Window was first opened, to update the models to the current price you can left click on the "Reset" button to update the window with the latest price.

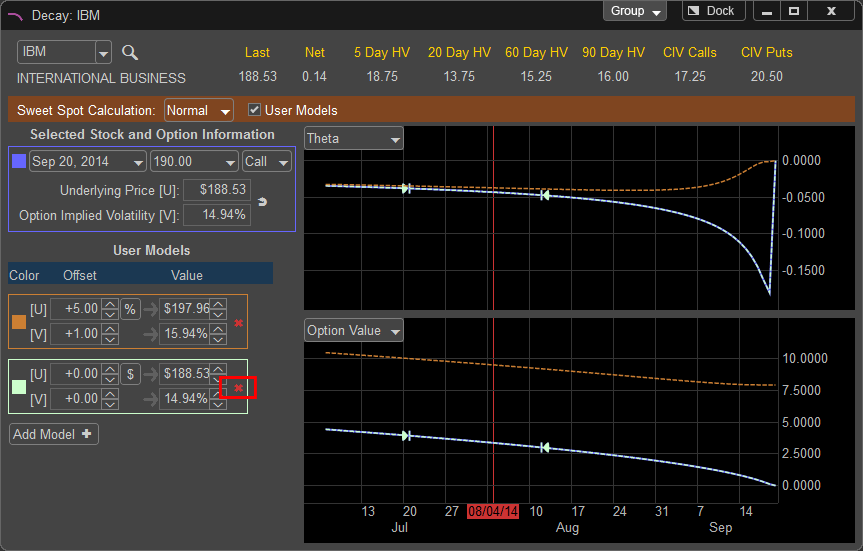

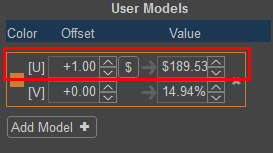

In the User Models section you can simulate a price change of the underlying by changing the values to the right of the [U] which represents Underlying Price

Under the Offset column you can change the price based on a dollar amount by left clicking the up or down arrows to the right of the value box. A value of +1.00 would simulate an increase of a $1.00 move in the underlying issue. A value of -1.00 simulates a $1.00 loss in value. You can also change the value by typing in a new price directly in the Value window.

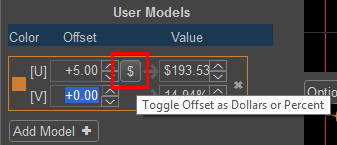

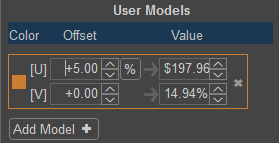

In addition to dollar value you can change the field to Percent Change by left clicking on the Dollar Sign button, this will change the Offset to Percent. A value of +5.00 in the Offset filed would represent a 5% increase in the price of IBM which is calculated in the Value column.

The current price of IBM is 188.53, a change of +1.00 in the offset field simulates the stock price being 189.53 an increase of $1.00. You can see how this effects both the Theta and Option Value on the right side of the Decay Window. The original model is represented by a blue line and the new updates price model is in orange as indicated by the colored box to the left of the Offset fields.

You can simulate a volatility change of the underlying by changing the values to the right of the [V] which represents Implied Volatility.

You can change the volatility by left clicking on the up and down arrows under the Offset field or by manually changing the Percentage in the Value field. A value of 1.00 in the Offset field represents a 1% change in implied volatility. The Offset has been changed to +1.00 and the volatility has been changed to 15.94%, an increase of 1%. The model based on these new values is displayed in the Decay Window by the orange line.

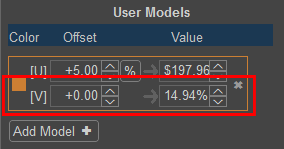

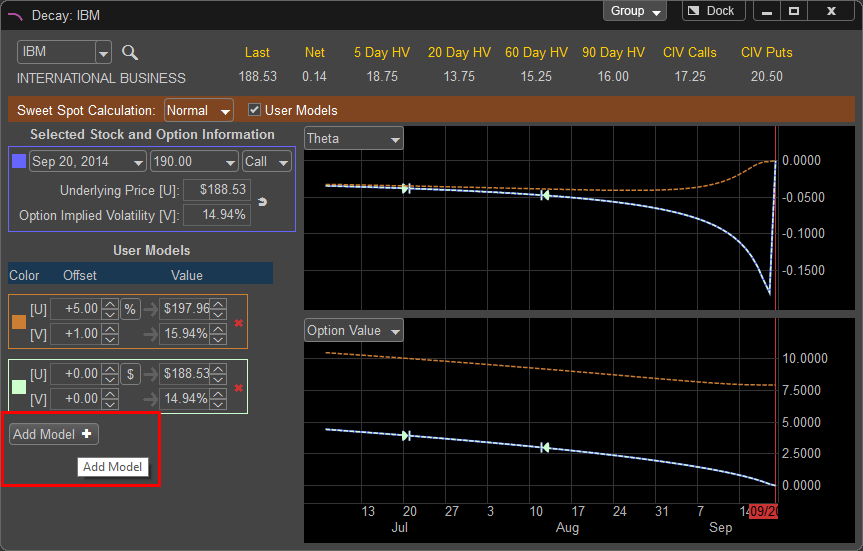

You can add up to 25 additional models to simulate various changes in both price and volatility by left clicking on the "Add Model" button.

To remove a model, left click on the red "X" to the right of the value fields.